Making sage work for business

LATEST NEWS

& UPDATES

Latest updates

UK IT & Legislation

Wharncliffe Team

Sage & Software News

And More!

News just in!

Acquisition of Wharncliffe Business Systems Limited

Innov8 Technology is proud to announce the acquisition of Wharncliffe Business Systems Limited, a fellow leading Sage Business Partner and technology provider.

Looking for support over Christmas?

Please note that our offices will close Friday 23th December 2022 and will re-open at 8:30am on Monday 3rd January 2023, however, we will continue to provide support services during the non-Bank Holiday days.

We have been awarded Sicon Growth Partner Award 2022!

We are delighted to announce that we have been awarded Sicon Growth Partner Award 2022!

Are you looking for something specific?

Sage CRM 2022 R2 Release

We’re delighted to let you know that Sage CRM 2022 R2 is now available.

Welcome to the team Samuel!

Welcome to Degree Apprentice Software Implementation Consultant Samuel

Sage 200 Professional 2022 R2 Release

As of 1 April 2022, all VAT-registered businesses will be required to use MTD for their VAT accounting.

Sage 200 Standard 2022 R2 Release

We’re delighted to announce the release of Sage 200 Standard 2022 R2.

The State of Ransomware 2022

As of 1 April 2022, all VAT-registered businesses will be required to use MTD for their VAT accounting.

Payroll year-end checklist: Here’s what your business needs to do

Payroll year-end is around the corner. Ideally, it should be just a standard month-12 or week-52 payroll with some extra steps added in to close the year. But it’s important to know what you need to get right.

Sage 200 Standard 2022 R1 Release

We’re delighted to let you know that the release of Sage 200 Standard and Sage for Education 2022 R1 is now available!

Richard, Stephen & Curtis Join the Team!

Richard, Stephen and Curtis join the Wharncliffe team! Richard & Stephen join the Operations Management team and Curtis as a Trainee Implementation Consultant.

Upcoming Legislation: Plastic Packaging Tax

From 1 April 2022, a new tax on plastic packing will come into force for UK businesses.

How to ensure you’re ready for MTD for VAT in April 2022

As of 1 April 2022, all VAT-registered businesses will be required to use MTD for their VAT accounting.

VAT Return Making Tax Digital

Making Tax Digital (MTD) is legislation from HMRC that currently affects how VAT-registered businesses do their VAT accounting.

Sage 200 2022 R1 Release

We’re delighted to announce the release of Sage 200 Professional 2022 R1

Sage CRM 2022 R1 Release

We’re delighted to let you know that the release of Sage CRM 2022 R1 is now available!

Welcoming Faizan & Michael to the Team!

Daniel and Liam join the Wharncliffe team. Daniel joins us as both an Account Manager and Implementation Consultant, and Liam joins as a Systems Engineer.

Sage 200 Standard 2021 R3 Release

Sage 200 Standard 2021 R3 is here! This release is themed around supporting a customers’ sales processes.

Congratulations to Adam on obtaining 100% on his Sage Partner Cloud Training!

Congratulations to Adam on obtaining 100% on his Sage Partner Cloud Training!

Liam is now a certified Acronis Architect!

Congratulations Liam on gaining his Acronis Architect qualification!

Brandan is now a qualified Acronis Architect!

Congratulations Brandan on gaining his Acronis Architect qualification!

Welcome to the team Dawn!

Welcome to Operations & Customer Service Coordinator Dawn

MTD for VAT FAQs: 19 key Making Tax Digital questions answered

Here are some of the most frequently asked questions around MTD for VAT and answers to them…

Daniel is now a Certified CRM Professional

Daniel has passed his CRM exam with a score of 93% and is now a Sage CRM Certified Professional.

MTD for Income Tax postponed

Details about the postponement of MTD for Income Tax and highlight why business owners should start taking a digital approach.

Adam, Ben & David Join the Team!

We’re delighted to welcome Adam, Ben and David to the Wharncliffe team!

How to upgrade to Windows 11

Windows 11 is now being rolled out to eligible PCs. Here’s a quick guide on how to update your PC to the latest version of Windows.

Visio is now available on Office 365

Visio ships as a web app which allows users to perform core functions and integrates with a variety of Microsoft solutions.

Welcoming Daniel & Liam to the Team!

Daniel and Liam join the Wharncliffe team. Daniel joins us as both an Account Manager and Implementation Consultant, and Liam joins as a Systems Engineer.

Celebrating 40 years in business!

We recently celebrated our 40th year in business! – We want to thank all of our customers, suppliers, partners and of course the Team for their support and hard work over the last 4 decades!

Windows 11 Launches October 5th

Windows 11 will become available on October 5, 2021. From this date, the free upgrade to Windows 11 will begin rolling out to eligible Windows 10 PCs and new PCs will be sold as standard with Windows 11.

Sage CRM 2021 R2 Release

We’re delighted to let you know that the release of Sage CRM 2021 R2 is now available!

Panintelligence awarded four accolades by G2

Panintelligence are proud to announce that they have been featured by G2 in four categories of their 2021 Summer Report.

Ian, Nirmal & Thomas join the Wharncliffe Team!

We’re delighted to welcome three new starters, Ian, Nirmal and Thomas to the Wharncliffe team!

Sage 200cloud Roadmap: See what Sage has planned

Following the latest release, the Sage 200cloud roadmap has been updated by Sage, containing details on previous and future releases.

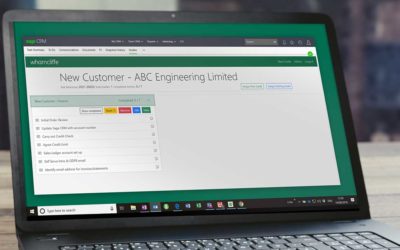

Guides for Sage CRM

Integrate your procedures, processes, troubleshooting, etc into your Sage CRM Tasks to ensure a consistent process is followed each and every time, with clear visibility on the progress of a Task!

Getting in touch…

Getting the answers you need is simple! You can call a member of our experienced team or a speak to our dedicated and knowledgeable sales team who can simply speak to you over the phone, arrange a meeting with you, or arrange a demonstration tailored to your business requirements.